Table of Contents

- What’s My 2024 Tax Bracket? | Hays Breard Financial Group

- Trump’s tax cuts could expire after 2025. Here’s how top-ranked ...

- How Tax Brackets Work: 2024 Guide | Money Instructor – Money Instructor

- 2024 Tax Cuts: New Stage 3 Tax Brackets Explained

- 2024 Standard Tax Deduction Head Of Household 2024 - Gretal Idaline

- What the 2024 Capital-Gains Tax Brackets Mean for Your Investments ...

- IRS announces 2024 income-tax brackets: Here’s what they mean for your ...

- WATCH: Budget 2024 - Implications for unchanged tax brackets

- Tax Brackets Single 2024 - Wally Jordanna

- IRS tax bracket adjustments: How to pay less taxes | wfmynews2.com

What are Tax Brackets?

2024 vs. 2023 IRS Tax Brackets: What's Changed?

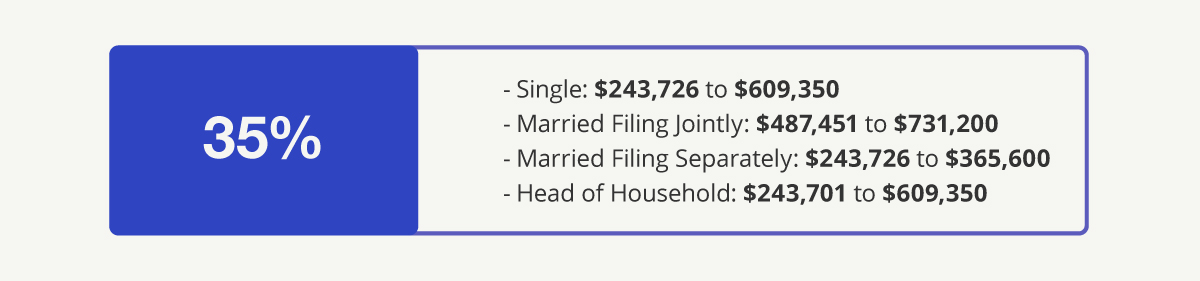

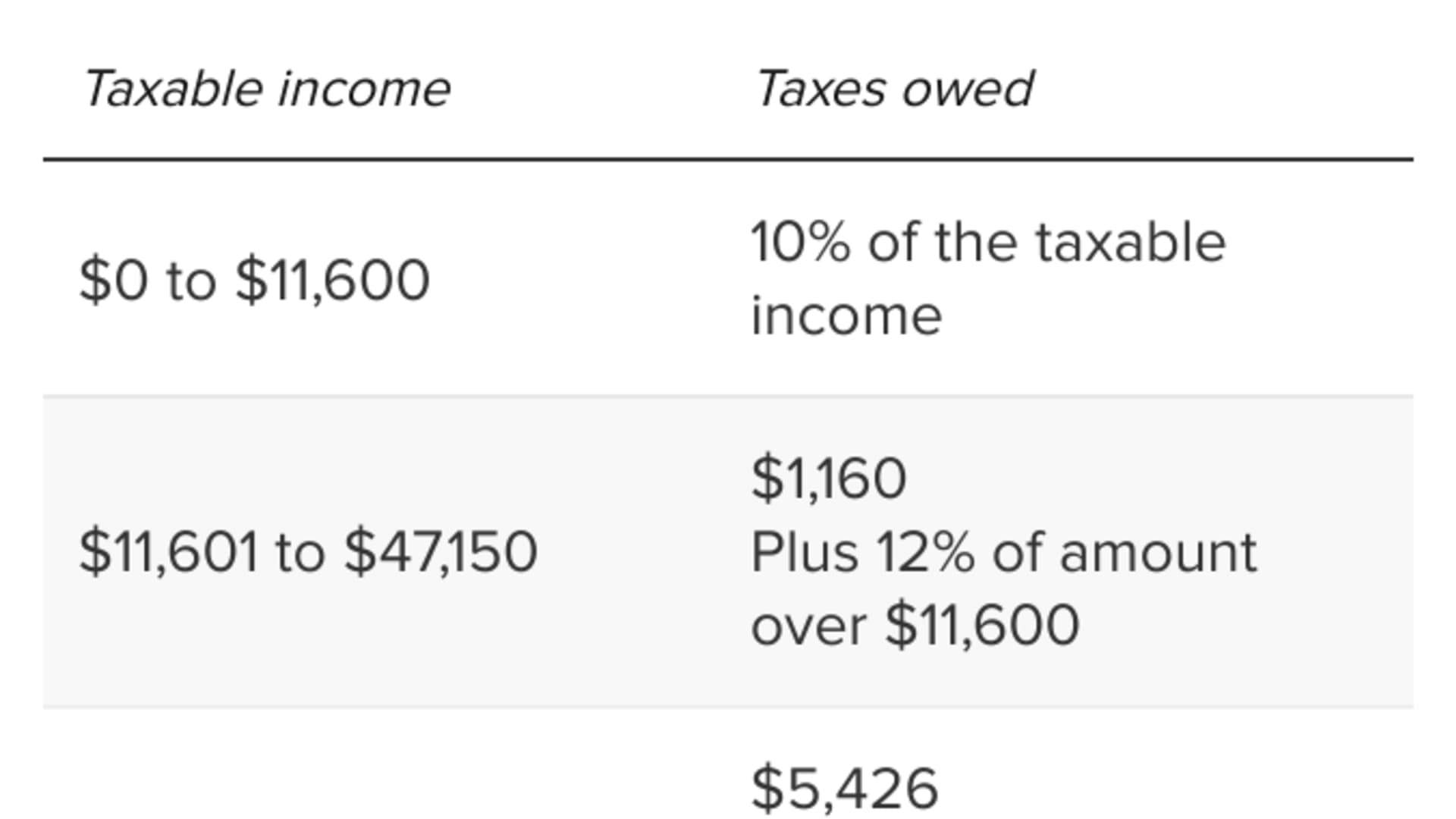

| Tax Filing Status | 2023 Tax Brackets | 2024 Tax Brackets |

|---|---|---|

| Single | 10%: $0 - $11,000 12%: $11,001 - $44,725 22%: $44,726 - $95,375 24%: $95,376 - $182,100 32%: $182,101 - $231,250 35%: $231,251 - $578,125 37%: $578,126+ |

10%: $0 - $11,600 12%: $11,601 - $47,150 22%: $47,151 - $100,525 24%: $100,526 - $191,950 32%: $191,951 - $243,725 35%: $243,726 - $609,350 37%: $609,351+ |

| Joint | 10%: $0 - $22,000 12%: $22,001 - $89,450 22%: $89,451 - $190,750 24%: $190,751 - $364,200 32%: $364,201 - $462,500 35%: $462,501 - $693,750 37%: $693,751+ |

10%: $0 - $23,200 12%: $23,201 - $94,300 22%: $94,301 - $201,050 24%: $201,051 - $383,900 32%: $383,901 - $487,450 35%: $487,451 - $738,200 37%: $738,201+ |

| Head of Household | 10%: $0 - $15,700 12%: $15,701 - $59,850 22%: $59,851 - $100,525 24%: $100,526 - $191,950 32%: $191,951 - $243,725 35%: $243,726 - $609,350 37%: $609,351+ |

10%: $0 - $16,400 12%: $16,401 - $63,550 22%: $63,551 - $106,550 24%: $106,551 - $202,950 32%: $202,951 - $255,450 35%: $255,451 - $644,850 37%: $644,851+ |